Trading tick In the fast-paced world of trading, where every second counts, traders are constantly seeking tools and techniques to gain an edge in the market. One such powerful tool that has gained popularity among traders is the trading tick. In this article, we will explore the concept of trading tick, its significance, and how it can be effectively used to enhance precision in trading decisions. Whether you’re a novice trader or an experienced professional, understanding the intricacies of trading tick can help you navigate the markets with greater accuracy.

Unveiling the Secrets of Trading Tick: A Powerful Tool for Precision

Demystifying the Trading Tick:

To grasp the essence of trading tick, let’s start with the basics. A trading tick refers to the incremental change in the price of an instrument within a given timeframe. It represents the movement of the price up or down by the smallest possible unit. For example, in a stock market, a tick could be one cent, whereas in the forex market, it could be a fraction of a pip.

The Significance of Trading Tick:

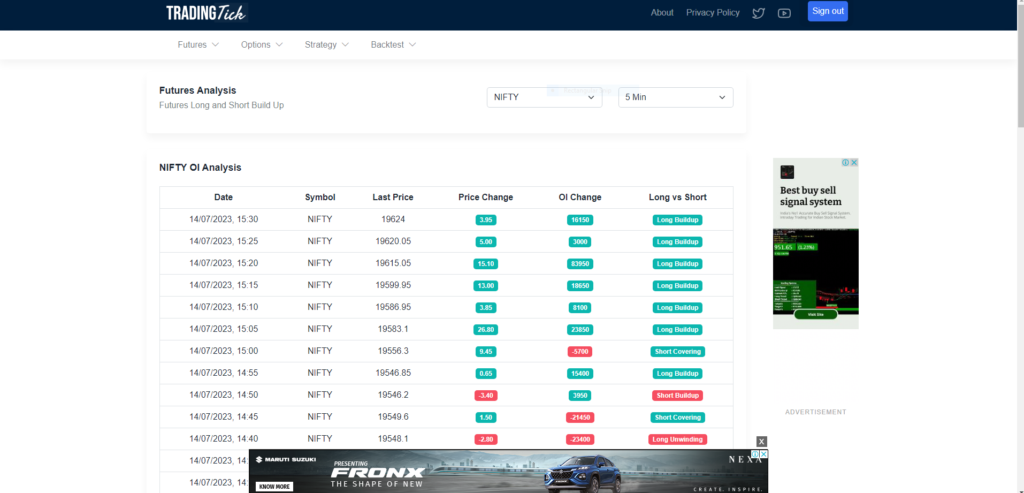

Trading tick provides traders with valuable information about market dynamics and price action. By closely monitoring tick movements, traders can gauge the intensity of buying and selling pressure in real-time. Understanding tick data allows traders to identif trends, assess market liquidity, and make informed trading decisions.

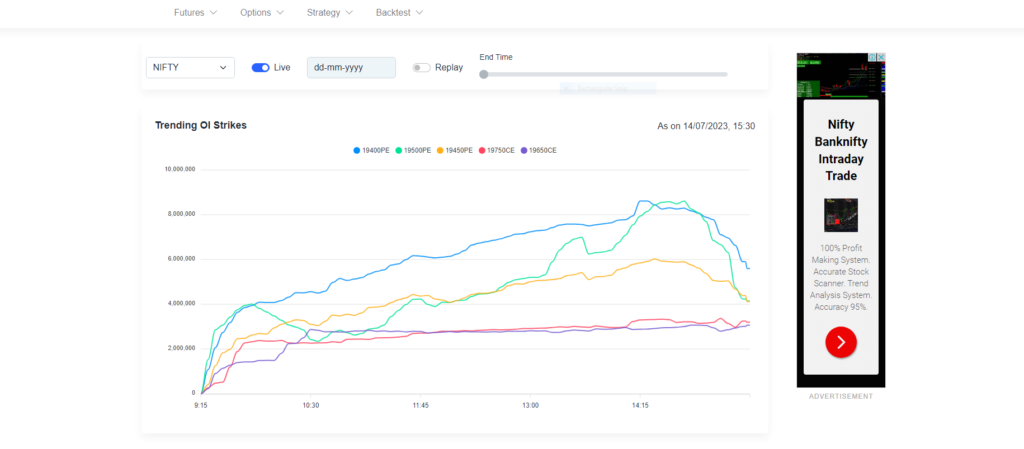

Tick Charts: A Visual Representation:

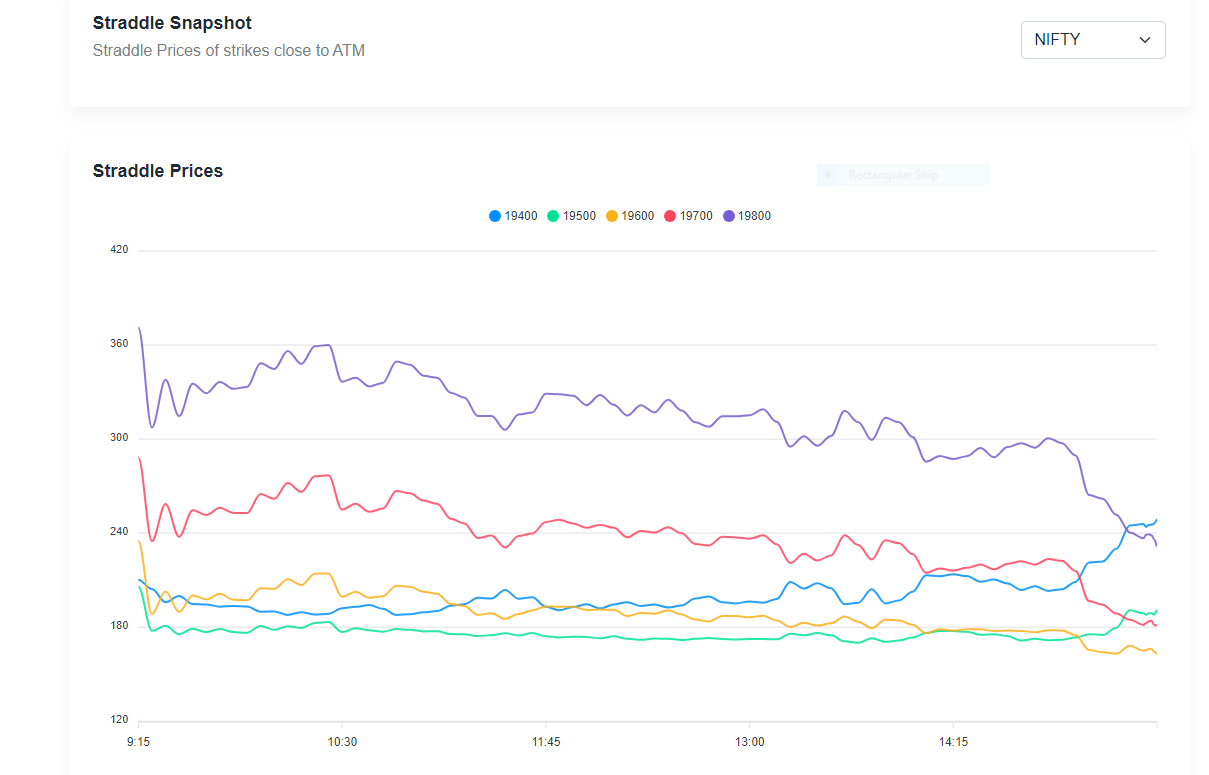

Tick charts are an effective way to visualize tick data. Unlike time-based charts, tick charts plot price changes based on a predefined number of ticks. This means that during periods of high trading activity, more bars will be formed, while during slower periods, fewer bars will appear. Tick charts offer a different perspective on market activity and can provide clearer insights into price patterns and trends.

Using Trading Tick for Entry and Exit Strategies:

Trading tick can be a valuable tool for developing entry and exit strategies. For instance, monitoring tick volume alongside price movements can help confirm the strength of a trend or identify potential reversals. Higher tick volumes during price advances indicate strong buying pressure, while lower tick volumes during pullbacks may suggest a weakening trend. By incorporating tick data into your strategy, you can fine-tune your timing and increase the accuracy of your trades.

Scalping and Day Trading with Tick Data:

Scalpers and day traders, who aim to capitalize on short-term price fluctuations, can benefit greatly from tick data analysis. By focusing on tick movements, traders can identify rapid shifts in market sentiment and take advantage of quick profit opportunities. Tick-based strategies can help pinpoint precise entry and exit points, allowing traders to maximize their returns in volatile market conditions.

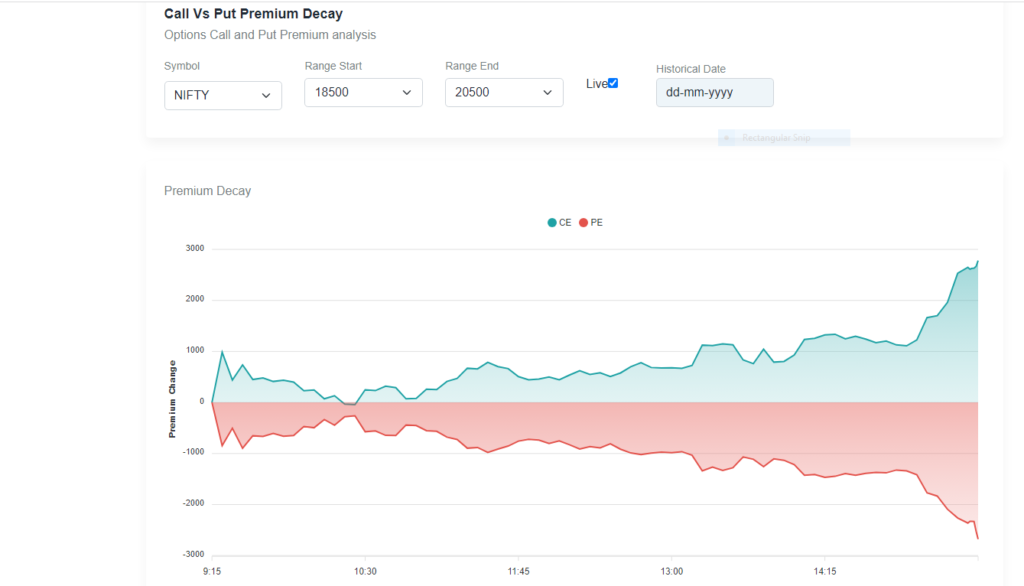

Tick-Based Indicators and Oscillators:

Several indicators and oscillators are specifically designed to work with tick data. These tools provide insights into market momentum, volatility, and overbought/oversold conditions. Examples of tick-based indicators include Tick Volume, Tick Index, and Tick Average. Integrating these indicators into your trading toolkit can enhance your decision-making process and help you stay ahead of the market.

Limitations and Considerations:

While trading tick can be a powerful tool, it’s important to understand its limitations. Tick data can vary between different brokers and trading platforms, leading to inconsistencies. Additionally, tick-based strategies require active monitoring and may not be suitable for all trading styles. It’s crucial to backtest and validate any strategy before deploying it in real-market conditions.

In the world of trading, precision and timing are of paramount importance. The trading tick, with its ability to capture incremental price changes and reflect market dynamics, can provide traders with a competitive advantage. By incorporating tick analysis into your trading approach, you can gain deeper insights into market trends, improve entry and exit strategies, and make more informed trading decisions. Remember, understanding the intricacies of trading tick takes time and practice, so don’t hesitate to experiment and refine your techniques. With diligence and a focus on trading tick, you can elevate your trading prowess and increase your chances of success in the dynamic world of financial markets.

When it comes to trading, there are several tips that can help traders increase their chances of success. Here are some of the best tips for trading:

- Educate Yourself: Knowledge is crucial in trading. Take the time to understand the financial markets, trading instruments, and different trading strategies. Continuously educate yourself by reading books, attending seminars, and staying updated with market news.

- Have a Trading Plan: Develop a well-defined trading plan that includes your trading goals, preferred trading style, risk tolerance, and money management rules. A trading plan will help you stay disciplined and focused on your objectives, and it serves as a roadmap for your trading decisions.

- Manage Risk: Effective risk management is essential for long-term success. Determine the amount of capital you’re willing to risk per trade, set stop-loss orders to limit potential losses, and use proper position sizing techniques. Never risk more than you can afford to lose.

- Start with a Demo Account: If you’re a beginner or testing a new strategy, start with a demo account. It allows you to practice trading in a simulated environment without risking real money. Use this opportunity to fine-tune your strategies and gain experience before trading with real funds.

- Choose a Trading Style that Suits You: There are various trading styles, such as day trading, swing trading, and position trading. Choose a style that aligns with your personality, schedule, and risk tolerance. Each style has its pros and cons, so find the one that suits you best.

- Use Stop-Loss Orders: Always use stop-loss orders to protect your capital. A stop-loss order is an instruction to sell a security when it reaches a specific price, limiting your potential losses. This helps you manage risk and avoid large drawdowns.

- Practice Patience and Discipline: Trading requires patience and discipline. Avoid impulsive trades driven by emotions, and stick to your trading plan. Don’t chase after every market move, but wait for high-probability setups that align with your strategy.

- Continuously Monitor and Adapt: Stay updated with market trends, news, and economic indicators. Monitor your trades and adapt your strategies as needed. Be flexible and willing to adjust your approach based on changing market conditions.Control Your Emotions: Emotions can cloud judgment and lead to poor trading decisions. Keep your emotions in check and don’t let fear or greed drive your actions. Stick to your plan and follow your trading rules.

- Learn from Your Mistakes: Trading involves learning from both successes and failures. Analyze your trades, identify mistakes, and learn from them. Keep a trading journal to track your progress and make adjustments based on your observations.

Remember, trading is a journey, and it takes time to develop expertise. Be patient, persistent, and dedicated to continuous learning. By implementing these tips and honing your skills, you can improve your trading performance and increase your chances of success in the financial markets.

9 thoughts on “Secrets of Trading Tick: A Powerful Tool for Precision #2”